Suite 2, 1 Railway Crescent

Croydon, Victoria 3136

Telephone : 03 9723 0522

Email: integrityone@iplan.com.au

Your Complete Financial Solution

Property investors will tell you that succeeding in real estate is all about timing. Just like shares, buying at the bottom and selling at the top is easier said than done.

Unless you have a crystal ball, there really is no clear-cut way to know exactly when the property market is at its peak or trough.

Whether you’re an investor, or a homebuyer, the next best thing to a time machine is research and due diligence.

While many experts agree that “time” is a popular buzz word when it comes to real estate, savvy buyers who look at the big picture acknowledge that it’s more about “time in the market” rather than “timing the market”.

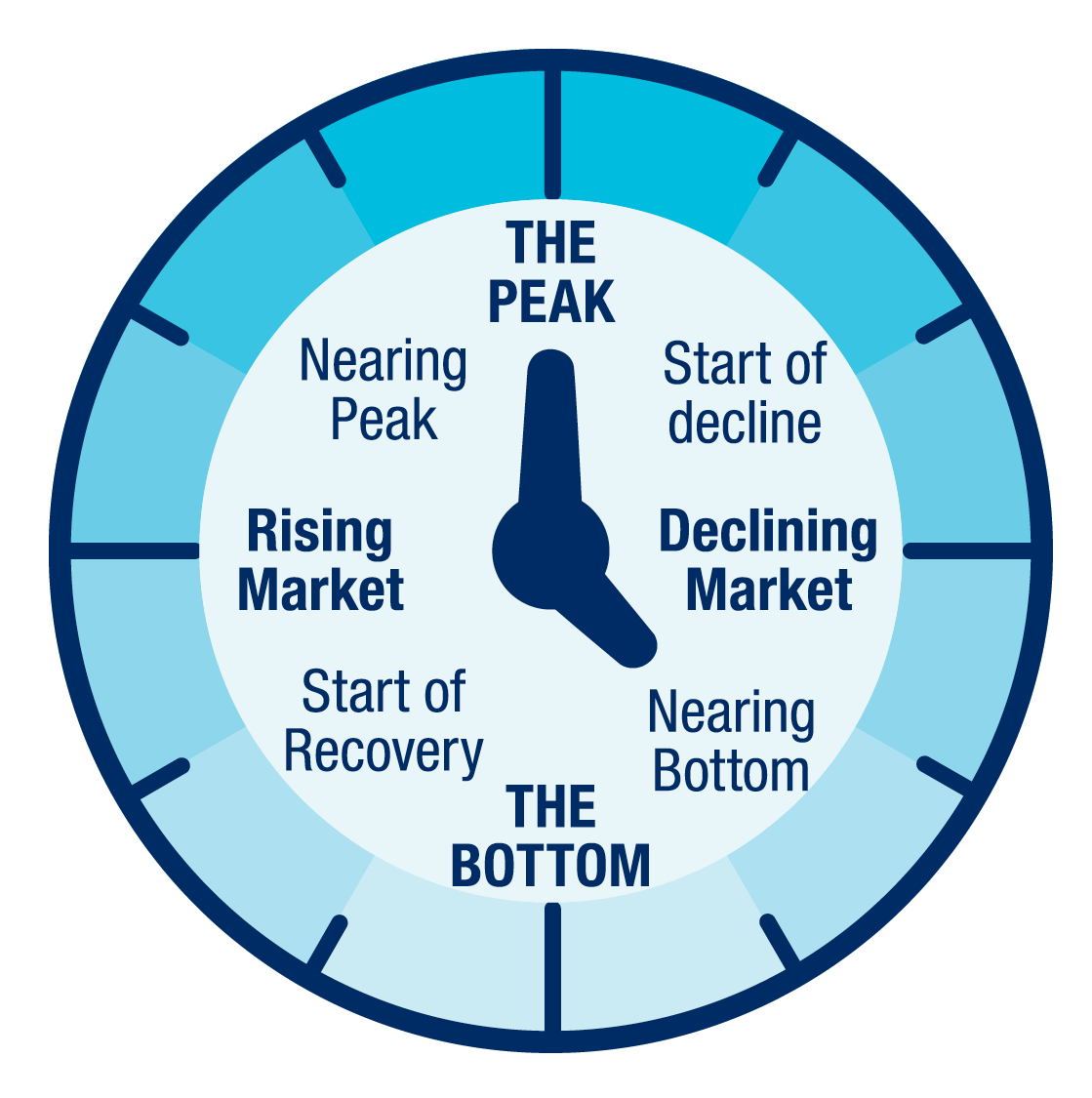

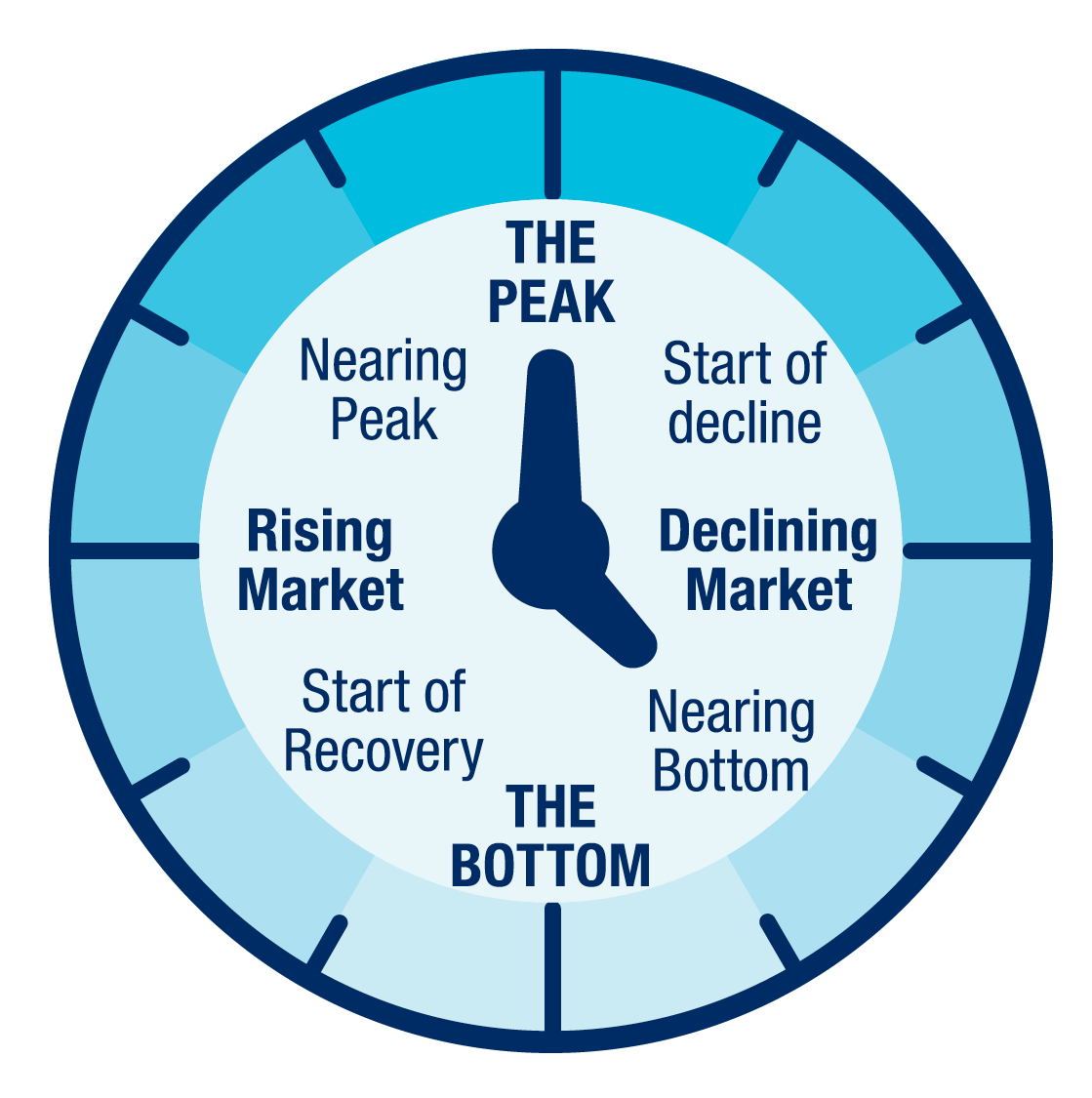

Everyone understands the principles of a clock, so some real estate analysts use this analogy to explain typical market cycles. If you were to think about an analogue clock, the hands move around the face in a clockwise direction representing where local markets are at, at any one point in time.

While the idea of a property clock is logical, life rarely is. So, the notion of a top and a bottom should be taken at face value.

The media, economists, and property experts, talk about the performance of major capitals, sometimes breaking them down into “house” and “unit” markets. They might also refer to “regional” or “rest of state” figures which effectively lumps hundreds of regional cities, towns and villages into one collective data dump.

Cities and towns might be heading one way as a whole, but dig deeper and some suburbs within those locations – and even streets or property types in those suburbs – can be running their own individual races.

This is why sellers, and buyers, should narrow their research to fit their own personal circumstances. The big picture is great for background knowledge, but knowing exactly what is happening where you plan to buy or sell is more relevant.

Remember, what keeps a particular property’s value ticking – or not ticking – comes down to the laws of supply and demand.

During the pandemic, there was a rush of people wanting to get out of the cramped quarters in our biggest cities and choosing to move to regional areas with more space and tranquility as they worked from home.

Interest rates were at record lows so people borrowed willingly to be able to secure their dream property. As a result, inner city apartments were out, bigger suburban (or country) homes were in and therefore houses and regional properties boomed.

By the beginning of 2022, the tables started turning and many locations (although not all) came off the “12 o’clock” spot and began to move clockwise, transitioning away from their market peak. Houses started to become unaffordable for many and in May 2022 interest rates started to increase so swiftly, the desire (and the ability) to pay top dollar for a property stopped.

Apartments (even inner-city ones) gradually started coming back into favour and less demand for high-priced houses saw values slip. But whether anywhere in the property market has reached the “6 o’clock bottom” is yet to be determined. Unfortunately, putting a pin in exactly when values hit a trough can often only been declared once the moment has passed.

Australia is a huge country with a diverse property market and varying cycle. Although, as a population we might experience the same external economic factors – such as inflation pressures and multiple interest rate rises – how each of them impact each corner of the country, can vary greatly.

Not even the most respected experts know exactly how long each cycle will be or the extent of the rises and falls. For example, when Covid hit many economists were signalling a property market crash – they couldn’t have been more wrong.

So, instead of having tunnel vision for timing the market, sophisticated property investors turn their attention to buying quality real estate in desirable locations that are traditionally more likely to hold their value and increase over time.

“Time” can also refer to the right time for you as a buyer because the best moment to dive into potentially the largest asset of your life is when you have your financial ducks in a row.

Experts are predicting that the market will continue to fall for the next few months, however, high-end properties in some areas have been bucking the trend and holding their value and continuing to sell quite well.

Economists are anticipating more cash rate hikes in 2023, with the possibility of rate cuts commencing in 2024 once inflation has stabilised.

While inflation is a concern for the RBA and given that there are still talks of a recession on the horizon, economic uncertainty will continue to affect buyer’s and seller’s confidence.

Whether you’re an investor or a homebuyer, holding out to buy at the bottom means you risk missing out on time in the market because as history has shown us – the longer you hold a home, the more valuable it may become.

To talk about the right time for you to make your next step onto the property ladder, speak to us today.

Suite 2, 1 Railway Crescent

Croydon, Victoria 3136

Telephone : 03 9723 0522

Email: integrityone@iplan.com.au

All Rights Reserved 2016 Copyright Integrity one

Integrity One Planning Services Pty Ltd (ABN 59 125 846 933) is a Corporate Representative (315000) of Integrity Financial Planners Pty Ltd (AFSL No. 225051).