“Don’t sail out farther than you can row back.” This Danish saying is sound advice for anyone thinking of borrowing to buy a home, particularly now that interest rates are low and house prices are generally rising.

According to a paper [1] for the Centre of Policy Development and University of Canberra, Australians have a tendency to be over-confident in our ability to repay loans. We also underestimate the likelihood of things potentially going wrong in our lives.

Have you ever heard yourself or someone else say “I’ll be able to repay my loan, provided I keep my job, don’t get sick and I’m not hit with any large unexpected bills”? Chances are you probably have. But things can and often do go wrong.

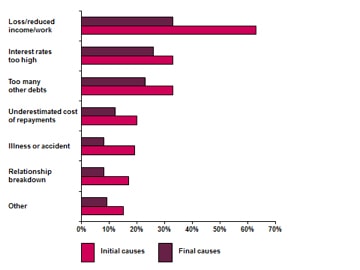

Causes of mortgage stress

A study [2] was completed for the Royal Melbourne Institute of Technology (RMIT), which looked at the specific triggers that have resulted in Australian households being unable to meet their mortgage repayments. Survey respondents were asked the initial causes and, if they changed, what the final causes were. They were also able to identify more than one cause. The graph below shows the results.

How to reduce stress

Like most things in life, it’s difficult to make borrowing a stress-free exercise, but there are a few things you can do to reduce the angst.

1. Review Maximum Loan Amount Offered

Most financial institutions determine the maximum loan they will provide based on a multiple of your income and other factors. But if you borrow the maximum amount, you may find you are stretched from day one unless you are very disciplined with your spending. Therefore it is important to consider if the maximum offered is suitable to your circumstances.

2. Build up a buffer

It’s a good idea to hold (or build up) a cash reserve in a mortgage offset account to provide a buffer that can be drawn upon to meet your loan repayments if you become ill or are off work for other reasons.

3. Take out mortgage protection insurance

Many lenders offer insurance when you take out a home loan that covers the mortgage (often up to a specified amount and for a particular period of time) if you die, become disabled or your employment ends involuntarily.

4. Take out personal insurances

While mortgage protection insurance can provide peace of mind for a limited time frame, other types of insurances should be considered. These include:

- Income Protection Insurance which can replace up to 75% of your income if you are unable to work due to illness or injury. This can ensure you are able to continue meeting the majority of your living expenses, not just your loan repayments.

- Critical Illness Insurance which can help you service or pay off your loan and meet a range of expenses in the event you suffer a specified illness, such as cancer or a heart attack.

- Total and Permanent Disability Insurance which can help you service or pay off your loan and provide an ongoing income if you become totally and permanently disabled.

- Life Insurance which can be used to service or pay off your loan and provide your family with an ongoing income if you pass away.

5. Fix the interest rate

Fixing the interest rate on your home loan can provide protection against rising interest rates. The downside is there are often restrictions on making additional payments into a fixed rate loan, which would limit your capacity to build up a buffer. Many people find a combination of fixed and variable rate loans works best, as additional repayments can be made into the variable rate portion of the debt.

6. Don’t add fuel to the fire

Over 40% of the people who completed the RMIT survey responded to the initial difficulty in meeting mortgage repayments by using credit cards more often than they normally would. Using debt to service debt is very likely to compound the problem.

7. Seek advice

At the first sign of a problem, it’s essential to seek financial advice, as there may be a range of potentially viable options to explore. Better still, you may want to seek financial advice before you decide how much to borrow.

An adviser can help you assess your spending plan and determine your affordability level. They can help you to focus on other goals you may want to achieve in the short, medium and long term and the cash flow that may be required to meet them. They can also assess your insurance needs and advise you on a range of other financial matters.

Footnotes

1. Source: Understanding human behaviour in financial decision making: Some insights from behavioural economics. Paper to accompany presentation to No Interest Loans Scheme Conference “Dignity in a Downturn” June 2009. Ian McAuley, Centre for Policy Development and University of Canberra.

2. Source: Mortgage default in Australia: nature, causes and social and economic Impacts. Authored by Mike Berry, Tony Dalton and Anitra Nelson for the Australian Housing and Urban Research Institute, RMIT Research Centre, March 2010.

Please contact Integrity One if we can assist you with this or any other financial matter.

Phone: (03) 9723 0522

Suite 2, 1 Railway Crescent

Croydon, Victoria 3136

Email: integrityone@iplan.com.au

This information is of a general nature and does not take into consideration anyone’s individual circumstances or objectives. Financial Planning activities only are provided by Integrity One Planning Services Pty Ltd as a Corporate Authorised Representative No. 315000 of Integrity Financial Planners Pty Ltd ABN 71 069 537 855 AFSL 225051. Integrity One Planning Services Pty Ltd and Integrity One Accounting and Business Advisory Services Pty Ltd are not liable for any financial loss resulting from decisions made based on this information. Please consult your adviser before making decisions using this information.