Following the lodgement of a home loan application, hopeful borrowers are often keen to know what will happen next and how long it will take for them to receive the verdict. The bad news is that there is no one-size-fits-all answer. The good news, however, is that a solid application is the key to keeping the approval time short.

The amount of time it takes for you to receive a response to your home loan application can vary. An answer is usually received between two days to two weeks, depending on a range of factors.

For a reasonably straightforward application, it’s around 48 hours to a final approval. But, depending on how complex the circumstances are, it can take longer than that.

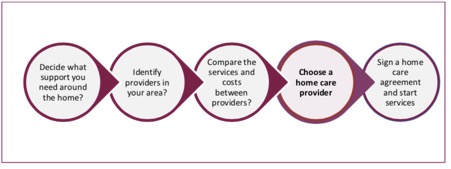

Before offering conditional approval, your potential lender will need to make an assessment of your application and conduct a valuation of the property. Of course, having a valuation that is acceptable to the lender done in advance will expedite the process.

With valuations, the intention is to support an application rather than to make or break it. There are a few things that can result in an application not being approved based on valuation, like zoning, property size, or if the condition of the property is poor enough that major repairs would be required before it could realise its market value.

The lender will also assess your capacity to repay the loan amount you have requested. This is where all of the information about your salary and liabilities come into consideration, and where accurate and complete information is essential.

The credit review by the lender can include a bit of to-and-fro between the customer, the broker and the lender due to the lender’s request for further information as that credit review takes place.

Your potential lender makes an overall judgement of you as a borrower and the complexity of your financial history will affect how long this takes.

It’s best to be full and frank in disclosure from a borrower’s perspective. The biggest red flag is non-disclosure of liabilities or adverse information on a credit history, whether it is included in documentation or not.

The complexity of the application process is a great reason why you would sit down with a reputable broker, as they can just explain all of that to you.

Following the submission of an application, you can expect your finance broker to be in touch with you to update you on progress, and to notify you of the outcome. If your application is approved, your broker will also advise you of when to expect a formal letter of approval from your lender.

Integrity One’s Mortgage & Finance Association of Australia accredited Finance Brokers Nic Berry and Tom Bailey are happy to speak to you about how they can simplify the home loan application and approval process, and create the strongest application for you.

Please contact Integrity One if we can assist you with this or any other financial matter.

Phone: (03) 9723 0522

Suite 2, 1 Railway Crescent

Croydon, Victoria 3136

Email: integrityone@iplan.com.au

Nicholas Berry Credit Representative Number 472439 and Thomas Bailey Credit Representative Number 472440 are Credit Representatives of Integrity Finance (Aust) Pty Ltd – Australian Credit Licence 392184.

This information is of a general nature and does not take into consideration anyone’s individual circumstances or objectives. Financial Planning activities only are provided by Integrity One Planning Services Pty Ltd as a Corporate Authorised Representative No. 315000 of Integrity Financial Planners Pty Ltd ABN 71 069 537 855 AFSL 225051. Integrity One Planning Services Pty Ltd and Integrity One Accounting and Business Advisory Services Pty Ltd are not liable for any financial loss resulting from decisions made based on this information. These articles are not owned by Integrity One Planning Services. Please consult your adviser before making decisions using this information.